|

|

|

|

- Year after year clients use Certificates of Deposits as a safe parking place for money that falls in to several categories: they have the money ear-marked for a specific purpose (travel, large purchase), they don’t want to put it at risk in the market, they don’t know of another financial instrument that will provide that safety and most importantly- no one has approached them with any other safe idea. Certainly, if their money IS intended to be used for something specific in the short term, a CD is an appropriate answer. But, what if that is not the case? Do you ask your clients or prospects, “How do you feel about the interest you’re getting at the bank on your safe money? Is that money intended for a certain purpose or purchase? No, it’s not? well, I have an idea for you……”

- Fixed annuities can provide a tax benefit (why pay tax on money being not used?), liquidity (10% liquid withdrawal whereas a CD is not liquid without a penalty from the bank) and yes, better interest rates. A 7 year MYGA fixed annuity is offering 3.30% currently and a 5 year is offering 2.85%. (state approval differs) Fixed Indexed Annuities (using a portion in the fixed account option) can provide an even greater opportunity for safe earnings. Call us to discuss your latest clients!

Looking for the latest 2016 tax summary guide? Download here

-

How will you guide your clients and prospects this year with new ideas? As we have known and anticipated for the last several years, interest rates are now on the way back up, and retirement income will be affected if bonds are the primary source. Have you considered the importance of showing a client what a guaranteed income would look like, one that has the opportunities to increase as the index performs?

Events For February

Ø American National (ANICO) will join us in presenting a Life Insurance and Annuity Workshop in our office locally on Wednesday, February 24, 2016 at 12 Noon-1pm with Jeff Moore, NSM. As a continuation of the ideas discussed on the Feb 9th Webinar, Jeff will continue in detail on the ANICO Life Insurance and Annuity case design opportunities for your business growth in 2016. There will be a light lunch served at 11:30am. Please call our office to reserve your seat at 248-644-1144.

Events For March

Ø Protective Life Insurance Company will join us in presenting a Life Insurance Workshop in our office locally on Tuesday, March 15, 2016 at 12 Noon to 1pm with Andy West, Regional Vice President. There are so many creative uses for Life Insurance from retirement supplement income, charitable giving, legacy planning, and more. Someone is asking your clients are their life insurance- why isn’t it you? A light lunch will be served at 11:30am. Please call our office to reserve your seat at 248-644-1144.

Eschels Financial Group

Eschels Financial Group

TAX DIVERSIFICATION AND THE ADVANTAGES OF LIFE INSURANCE AND ANNUITIES

|

Your clients must pay taxes during at least one of three time periods: contribution, accumulation, or distribution. That’s the bad news. The good news is that the IRS effectively allows you to pick which phase their savings will be taxed during via the use of different financial products.

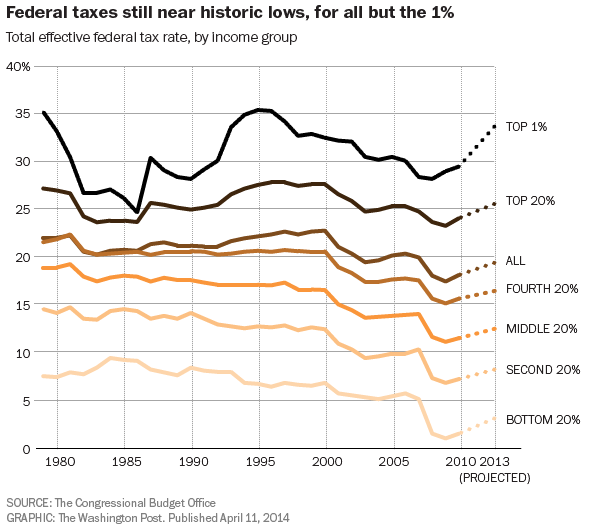

Furthermore, while it may not feel like it, current effective federal tax rates are near historic lows. And with the Congressional Budget Office projecting that the total Federal debt is set to explode over the next 10 years, it’s reasonable to wonder if your clients’ effective tax rates will be higher in the future. Which is when traditional retirement vehicles, such as 401(k)s and IRAs, would be at their highest values and expected to be called upon to begin providing distributions.

Thankfully, life insurance policies that accumulate value are one of the few options that are not taxed during accumulation and have tax-advantaged methods of distribution. So consider suggesting life insurance to your clients as a tax diversification strategy and help protect them against the risk of future tax increases.

Below you’ll find resources to help you describe the tax advantages of annuities and life insurance to your clients. Review and call me to discuss how we can help you implement these strategies into your practice!

.png)

|

|

|

| Insights That Shape the Future Tax Rate Outlook: |

- At current tax rates and expenditure levels, tax revenues are projected to be fully consumed by 2030

- The federal government had $74.3 trillion in debts, liabilities, and unfunded obligations at the close of its 2014 fiscal year

- Budget deficits are projected to nearly double by 2024 as retiring baby boomers strain the health and retirement systems

|

|

|

|

|

|

|

|

|

The stock market can be an uncomfortable place for some clients.

The stock market can be an uncomfortable place for some clients.

Consider these three recent bull markets*:

- 1997-2000: Up 100% before declining 86%

- 2003-2008: Up 90% before declining 53%

- 2009-2014: Up 142%… where do you think the market will go from here? Now could be a great time to exercise a “correction protection” strategy for your clients by investing in the Protective Indexed Annuity II.

If you have clients nearing retirement who are concerned about another decline, ,help them exercise “correction protection” by taking their gains out of the market and investing it in the Protective Indexed Annuity II. This solution provides protected growth, opportunities for higher returns, and even offers secure retirement income with SecurePay SE, an optional withdrawal benefit.

Contact me now for more information:

|

|

|

|

|

|

|

|

|

|